Eligible for VAT Relief on lightweight mobility scooter

Usually when you buy something, a seller has to add 20% VAT to the price. VAT stands for Value Added Tax. Our scooters are designed specifically for certain disabilities so they can be offered with VAT Relief - which means we don't have to add the 20% if you are also eligible.

VAT Relief is for chronically sick or disabled people. You can buy eligible items at 0% rather than 20% VAT - thus saving you a significant amount of money. It is easy to do this as we have a simple claim form at point of order.

Who is eligible for VAT Relief?

To be eligible for VAT relief, the product needs to be for a person who permanently resides in the UK and who is 'chronically sick or disabled'. This is further defined as a person:

With a physical or mental impairment which has a long-term and substantial adverse effect upon his/her ability to carry out everyday activities - for example, with a condition which the medical profession treats as a chronic sickness, such as diabetes; or who is terminally ill.

Important Note: It does NOT include a frail elderly person who is otherwise able-bodied or any person who is only temporarily disabled or incapacitated, such as with a broken limb.

Charities can also claim VAT Relief so long as the products are for use by chronically sick or disabled people.

What proof do we need you to give us?

In order to waive VAT on eligible purchases, the government requires a simple declaration to be made as to the nature of your disability at the time of ordering. No proof of your disability need be shown to any party at any time.

Its very easy to claim VAT Relief, all we need to know is the name, address & disability of the person the item is for & what their chronic sickness or disability is. We do not need a doctor's letter or any reference numbers.

The above information can be easily provided during the point of sale. All information collected is completely confidential.

Which Items are eligible?

VAT Relief only applies to certain items; these are items which have been designed to be used by someone who is chronically sick or disabled. If an item is displayed as 'Available with VAT Relief' or the price is shown "with VAT Relief" on our site, and you are eligible (as above) then you are entitled to buy these products with VAT Relief.

Displayed Prices

If you view a product you will see the words, "Available with VAT Relief" on the product, then VAT relief can be claimed on that item.

Things to Remember

- We do NOT decide if an item is or isn't exempt and we don't make any more or less money if we charge you VAT or we don't charge you VAT.

- If you do not complete the VAT exemption form, or you are not eligible for VAT relief, we are obliged to charge you the full prevailing VAT on the whole of your order.

- Not all products are eligible for VAT relief, so we are obliged to charge VAT at the prevailing rate for those products that are not VAT exempt, even after you complete this form.

- Visit the Government page on VAT for disabled people section, that also has links to other financial help if you are disabled.

What battery can I use for my lightweight mobility scooter? Which battery is best?

Taking your lightweight mobility scooter on an aeroplane. Thinking of flying?

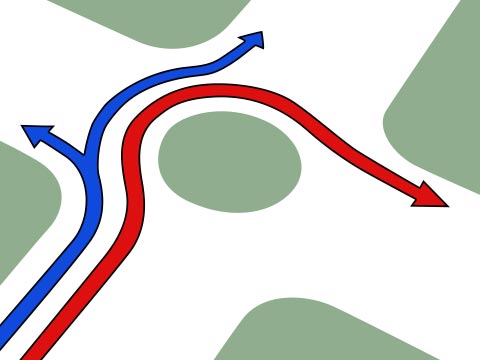

Do we need a Highway Code for mobility scooter users? Mobility Highway Code

What does a home demonstration involve? Home Demonstrations

Read more mobility articles